By Compassionate Finance on Nov 6, 2018 1:18:00 PM

Dental bills are not a huge part of household budgets or personal debt. At first glance, that information seems to be good news. Wrong. It’s not and the reason why should concern everyone.

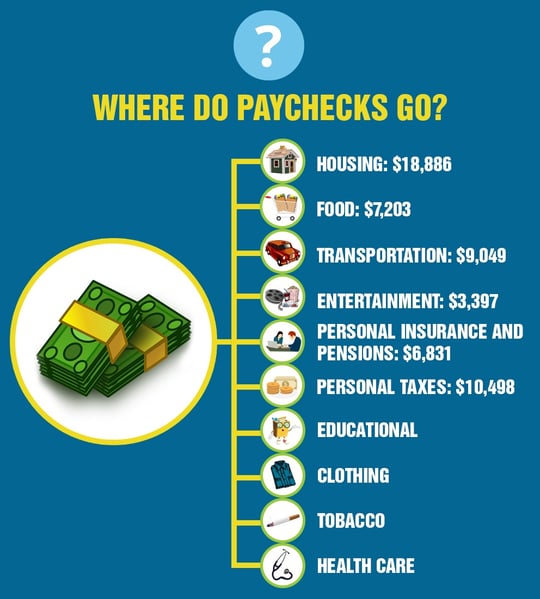

WHERE DO PAYCHECKS GO?

With an unemployment rate at 3.8%, most employable adults are working. Cheers all around! Unfortunately, 80% of Americans live from paycheck to paycheck, which takes a bit of the sparkle out of the fireworks. People are saving less money than before. So where does all that new employment money go?

According to USA TODAY and the Bureau of Labor Statistics, the average American household earns $74,664 annually. From that amount, here’s where the money ends up:

-HOUSING: $18,886. This includes rent, mortgages, property taxes, utilities, furniture and upkeep on everything to the tune of $1,573 a month.

-FOOD: $7,203. $3,154 of that is sent eating from somewhere other than your own kitchen.

-TRANSPORTATION: $9,049. Cars, gas, insurance and upkeep are not cheap and public transport adds up.

-ENTERTAINMENT: $3,397. This includes alcohol, pets, your cable and internet subscriptions, concerts, football games and pretty much anything else that is fun.

-PERSONAL INSURANCE AND PENSIONS: $6,831. This includes life insurance, pension contributions and your Social Security payroll tax.

-PERSONAL TAXES: $10,498.

You also have educational costs ($1,329), clothing ($1,803), tobacco ($337) and a variety of other expenses. Then we come to this one: $4,612, which is the cost of health care. This includes prescriptions, medical devices and services. Oddly, in this detailed run-down of where people’s money goes, there’s no mention of dental costs.

DENTAL COSTS?

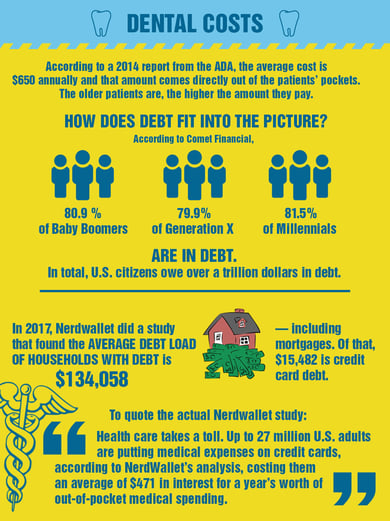

What about dental treatment and financing for regular dental check-ups? According to a 2014 report from the ADA, the average cost is $650 annually and that amount comes directly out of the patients’ pockets. The older patients are, the higher the amount they pay. The statistics vary, depending on age groups and the use of insurance. How much of that ends up being part of a household’s debt load is a tricky subject—but more on that later.

HOW DOES DEBT FIT INTO THE PICTURE?

HOW DOES DEBT FIT INTO THE PICTURE?

Pretty much everyone is in debt. Except for minor children, most U.S. citizens bear the cost of credit. According to Comet Financial 80.9 % of Baby Boomers, 79.9% of Generation X and 81.5% of Millennials are in debt. In total, U.S. citizens owe over a trillion dollars in debt. A good portion of that is comprised of mortgage and student loans, but the debt that worries most economists—and the people who carry those debts—is credit card debt. In 2017, Nerdwallet did a study that found the average debt load of households with debt is $134,058—including mortgages. Of that, $15,482 is credit card debt. To quote the actual Nerdwallet study: “Health care takes a toll. Up to 27 million U.S. adults are putting medical expenses on credit cards, according to NerdWallet’s analysis, costing them an average of $471 in interest for a year’s worth of out-of-pocket medical spending.” In other words, a household debt load is, on average and leaving out housing costs, greater than what is spent on taxes, food or transportation.

WHAT ABOUT THOSE DENTAL COSTS?

The Internet is rippling with information about dental treatment costs and dental financing options. But how do dental bills fit in with other household bills? That’s a little awkward. In many instances, dental costs are folded in with “other” statistics, like “medical” and “insurance costs.” But there is another more disturbing reason for lack of information on how people pay for dental bills: People are not getting treatment and therefore don’t have any dental bills to pay.

To drive home this point, look up an article from The National Bankruptcy Forum, titled: TEN STATISTICS ABOUT U.S. MEDICAL DEBT THAT WILL SHOCK YOU. Item number 2 states: “Dental care, prescription drugs, and eyeglasses are the first things people give up because of health costs.” Again, dental care is the first “luxury” that people give up when money gets tight.

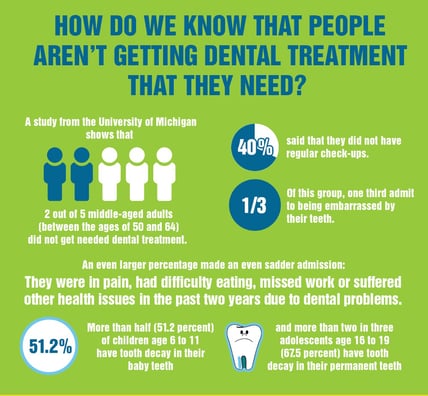

HOW DO WE KNOW THAT PEOPLE AREN’T GETTING DENTAL TREATMENT THAT THEY NEED?

While a large segment of the population isn’t incurring dental bills, a huge percentage needs dental treatment or, at the very least, regular check-ups. A study from the University of Michigan shows that 2 out of 5 middle-aged adults (between the ages of 50 and 64) did not get needed dental treatment. 40% said that they did not have regular check-ups. Of this group, one third admit to being embarrassed by their teeth. An even larger percentage made an even sadder admission: They were in pain, had difficulty eating, missed work or suffered other health issues in the past two years due to dental problems.

Read that again. That’s millions of people in pain, missing work or getting physically sick because of lack of dental care. That’s just one study and one group. Here’s a quote from a 2012 Family USA study:

“Tooth decay has become a childhood epidemic. More than half (51.2 percent) of children age 6 to 11 have tooth decay in their baby teeth, and more than two in three adolescents age 16 to 19 (67.5 percent) have tooth decay in their permanent teeth. Tooth decay is far more common than chronic childhood diseases like asthma and diabetes.”

Much has changed since 2012…or has it? In 2014, no less of an authority than the Center for Disease Control posted statistics from the United States Health Tables: The percentage of children aged 5-19 years with untreated dental work—18.6%. The percentage of adults aged 20-44 with untreated dental work is 31.6%.

In 2018, an article about Medicaid and Medicare in the New York Times discussed the widespread problems caused in the general medical field due to lack of dental care and dental treatment coverage.

The evidence is overwhelming. Dental care is sorely lacking throughout the country. Even people with health and dental insurance coverage find themselves struggling to afford dental treatment. And the costs of this shortfall are winnowing through our entire economic system. Poor oral health contributes to a variety of serious health concerns, like heart disease and cancer, as we discussed in our previous blog (LINK TO PREVIOUS BLOG). These health concerns exact a hefty price on medical insurance companies, government medical programs and the people who suffer from illnesses that could have been helped by a regular check-up. In some instances, lack of dental care can prove fatal.

THE BIGGEST PROBLEM REGARDING DENTAL BILLS

…is that a significant portion of Americans don’t see their dentists—if they even have a dentist. They don’t have bills because they forgo dental treatment. The main reason for this is the cost.

Compassionate Finance is working hard to give patients options beyond high-interest credit card debt. Dental professionals need to put their valuable education to work and provide patients with necessary dental treatment. Talk to us about how we can help you deliver your services to your community.

comments